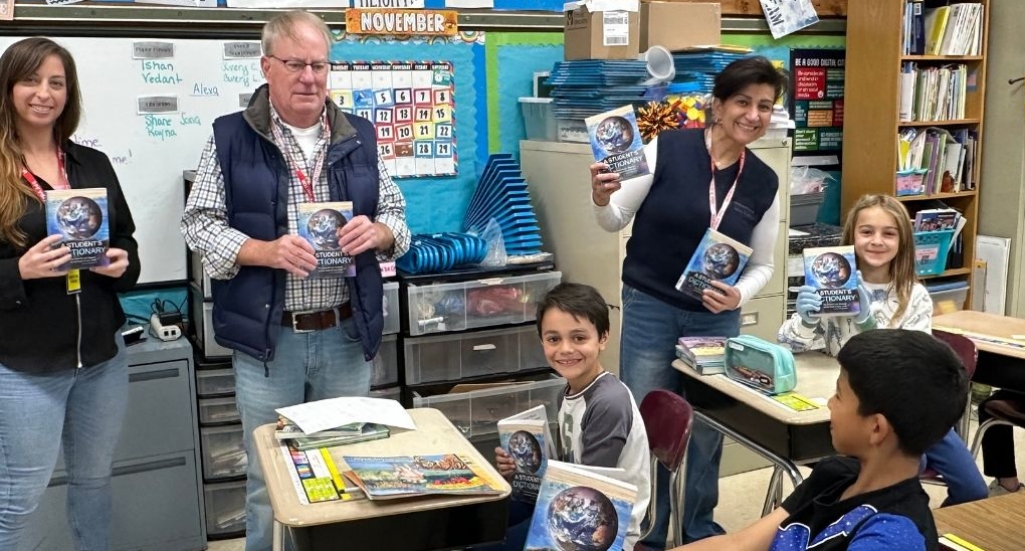

Our team was honored to partner with friends in the Fanwood-Scotch Plains community to hand out dictionaries to students of Evergreen Elementary and introduce them to basic banking and financial literacy terms.

As part of our continued Credit Union Kind Day efforts, Advanced Financial organized a "Sock-tober" sock donation drive throughout the month of October. Through this simple act of kindness, we're proud to make a lasting impact on the communities we call home by bringing local residents joy, warmth, and comfort.

Valentine’s Day is a time to celebrate love, and what better way to show your affection than by building a stronger financial future together? Money may not be the most romantic topic, but when handled with care, it can enhance your relationship and set the stage for long-term happiness. Here are some tips for managing money as a couple:

Have an Open Conversation

Start by having a candid discussion about your financial goals, debt, and spending habits. Understanding each other's financial situations will help avoid surprises and lay a strong foundation for your future together.

Set Shared Goals

Whether it’s buying a home, saving for a vacation, or paying off debt, setting mutual goals keeps both of you on the same page. Break these goals into manageable steps and celebrate all your wins along the way!

Create a Budget Together

Work as a team to build a budget that aligns with your shared goals. Tracking your income and expenses together can help you steer clear of overspending, while staying focused on what’s important.

Split Responsibilities

Divide financial responsibilities based on what makes the most sense for each of you. For example, one of you may want to be the person to handle all the bills, while the other focuses on saving and/or investing. This will help ensure that neither of you feels overwhelmed.

Be Supportive

Financial ups and downs are part of life, and supporting each other during tough times is key. Whether it’s sticking to your well-thought-out budget or navigating pesky unexpected expenses, maintaining open communication will keep your financial love strong.

Remember, love and money don’t have to be stressful! By working together, you can build a healthy financial future and enjoy the journey.

Our routing number for direct Deposits: 221276817

Federally Insured by NCUA

We do business in accordance with the fair housing law and equal opportunity act