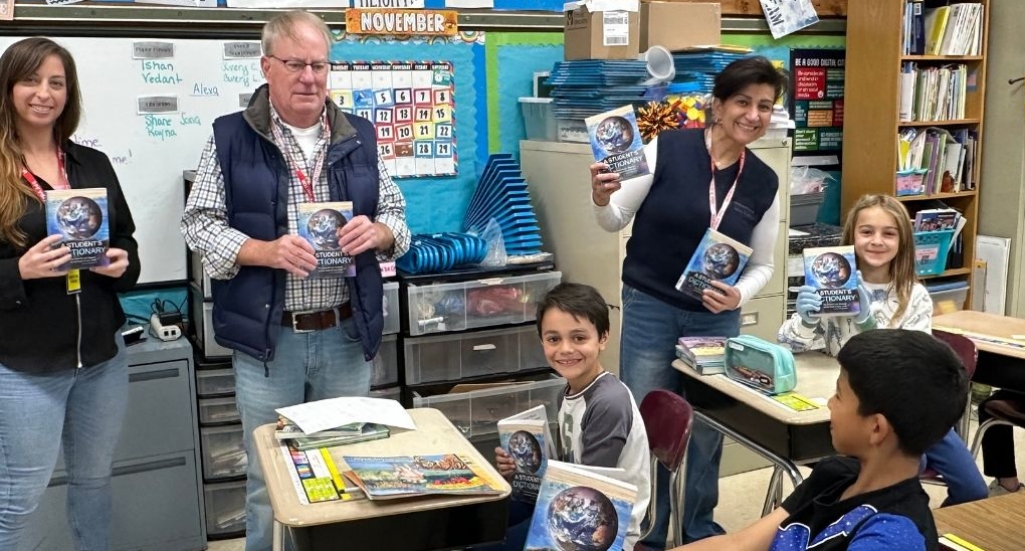

Our team was honored to partner with friends in the Fanwood-Scotch Plains community to hand out dictionaries to students of Evergreen Elementary and introduce them to basic banking and financial literacy terms.

As part of our continued Credit Union Kind Day efforts, Advanced Financial organized a "Sock-tober" sock donation drive throughout the month of October. Through this simple act of kindness, we're proud to make a lasting impact on the communities we call home by bringing local residents joy, warmth, and comfort.

While your credit score is a three-digit number that's automatically assigned to you, this is one area of your financial life where you have quite a bit of control. The moves you make or don't make with your credit can help determine where this score falls at any time, and the impact can be dramatic.

Where good credit, a score of 670 or higher, can mean having access to financing with the best rates and terms, a low credit score can mean paying higher interest rates and more loan fees — or even being denied financing altogether. Bad credit can also mean having trouble getting an apartment or a job if your employer asks to see your credit report for hiring purposes.

The following steps can help you improve your credit this year and beyond:

You don’t have to live with a low credit score for another year, especially since so many things can help you improve it. By never missing a payment, paying down debt, checking over your credit reports and getting creative when it comes to building new credit, you can end 2024 in much better shape.

From Swift and Associates - Our Tax Preparation Partner

Our routing number for direct Deposits: 221276817

Federally Insured by NCUA

We do business in accordance with the fair housing law and equal opportunity act